Sri Lanka has secured a deal to move forward on restructuring about $12 billion of international bonds, the government said on Wednesday, a major step in the island nation's fragile recovery from a severe financial crisis.

The agreement brings the nation closer to completing its debt overhaul two years after it defaulted.

Bondholders and the Sri Lanka agreed to a framework for a deal that includes notes linked to economic performance and a governance-linked structure as part of plain vanilla instruments, according to a statement released Wednesday at the conclusion of the second round of restricted talks.

Sri Lanka defaulted for the first time on its foreign debt in May 2022 after its economy was driven to the brink by a slump in foreign exchange reserves.

Restructuring international bonds was one of the key conditions set by the International Monetary Fund (IMF) under a $2.9 billion bailout programme that helped Sri Lanka tame inflation, stabilise its currency, and improve public finances.

The deal with selected bondholders, who cover about 50% of Sri Lanka's bonds, is contingent on confirmation by the Official Creditor Committee (OCC) made up of bilateral creditors and the IMF to ensure it is in line with the global lender's debt sustainability analysis for the country.

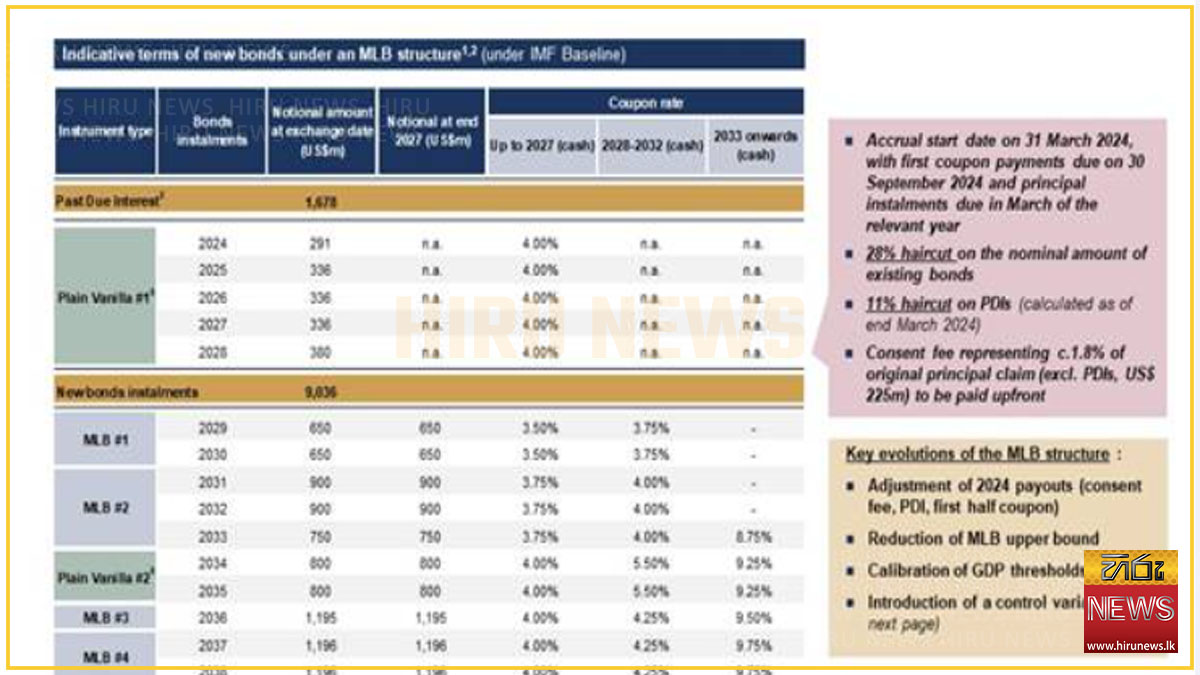

The framework proposes a 28% haircut on face value and 11% reduction on past interest with payments on the interest component to start from September.

The outline proposes to swap four existing dollar-denominated bonds for a bundle of three fixed income instruments.

One is a standard or so-called "plain vanilla" bond that has a coupon of 4% and matures in 2028. The second is a series of macro-linked bonds, where payouts and principal will be adjusted according to the country's economic performance - downwards in case the economy fails to hit the IMF baseline projections, and upwards if the economy outperforms.

It's lost 34% over the past year while the wider S&P 500 rose 25%.

A third instrument would be a so-called governance linked bond. While the statement did not detail the parameters to which the payout was linked, a source familiar with the situation said the country would have to pay investors less if it managed to achieve reforms demanded by the IMF and hit tax revenue targets.

Sri Lankan sovereign dollar bonds were marginally up in price on Wednesday, still trading around 57 or 58 cents on the dollar. The bonds were up nearly 15% year to date at the index level up to Tuesday's close, according to JPMorgan data.

Sri Lanka signed in late June an agreement with creditor nations including Japan, India and China to restructure about $10 billion in bilateral debt.

Sri Lanka now needs to present the proposal to all its bondholders who need to agree to the deal for the restructuring to be finalised.

The statement is given below;

ANNOUNCEMENT BY THE GOVERNMENT OF THE DEMOCRATIC SOCIALIST REPUBLIC OF SRI LANKA IN RELATION TO THE FOLLOWING SERIES OF BONDS ISSUED BY THE ISSUER:

U.S.$1,000,000,000 6.85% BONDS DUE 2024

Rule 144A ISINs: US85227SAY28; Reg S ISIN: USY8137FAN88

U.S.$500,000,000 6.35% BONDS DUE 2024

Rule 144A ISINs: US85227SBA33; Reg S ISIN: USY8137FAQ10

U.S $1,400,000,000 7.85% BONDS DUE 2029

Rule 144A ISINs: US85227SAZ92; Reg S ISIN: USY8137FAP37

U.S $1,500,000,000 7.55% BONDS DUE 2030

Rule 144A ISINs: US85227SBB16; Reg S ISIN: USY8137FAR92

(the "Bonds")

SRI LANKA ANNOUNCES SUCCESSFUL CONCLUSION OF SECOND ROUND OF RESTRICTED DISCUSSIONS WITH MEMBERS OF THE AD HOC GROUP OF BONDHOLDERS

Colombo, Sri Lanka, 3 July 2024 - The Government of the Democratic Socialist Republic of Sri Lanka ("Sri Lanka") announces today that it has held restricted discussions between 21 June 2024 and 2 July 2024 (the "Restricted Period") with nine members of the steering committee who agreed to take part in the restricted discussions (the "Steering Committee") of the Ad Hoc Group of Bondholders (the "Group", and together with Sri Lanka, the "Parties") of its International Sovereign Bonds ("ISBs"). Sri Lanka was joined by its legal and financial advisors, Clifford Chance LLP and Lazard, respectively, and the restricted members of the Steering Committee were joined by the Group's legal and financial advisors, White & Case and Rothschild & Co, respectively. The Steering Committee as a whole comprises ten of the largest members of the Group, with the Group controlling approximately 50% of the aggregate outstanding amount of ISBs.

During the Restricted Period, Sri Lanka, the Steering Committee and its advisors met during a two-day working session in Paris on 27 and 28 June 2024 (the "Meetings"). At the conclusion of the Meetings, Sri Lanka is pleased to report that, following negotiations, the Parties agreed core financial terms of a restructuring of the ISBs, the terms of which are embodied in a joint working debt treatment framework (the "Joint Working Framework"), a copy of which is included in the Annex to this announcement (which is also available as a PDF version through the link at the bottom of this announcement). In addition, the Parties agreed to include Governance-linked Bond features in the terms of one or more series of the plain vanilla bond instruments that form part of the Joint Working Framework.

As the Joint Working Framework includes a state-contingent feature, it remains to be confirmed by (i) the Secretariat of Sri Lanka's Official Creditor Committee (the "OCC") to ensure comparability of treatment with the terms agreed between Sri Lanka and the OCC ("Comparability of Treatment") and (ii) the IMF staff to ensure consistency with the parameters and debt sustainability objectives of Sri Lanka's IMF-supported Program. As such, following the Meetings, the advisors to Sri Lanka and the Steering Committee will consult with each of the Secretariat of the OCC, to confirm the consistency of the Joint Working Framework with the principle of Comparability of Treatment, and staff at the IMF, to confirm the consistency of the Joint Working Framework with the parameters and debt sustainability objectives of Sri Lanka's IMF-supported Program.

During the restricted discussions, Sri Lanka and the Steering Committee also progressed discussions on certain non-financial provisions.

Sri Lanka would like to thank the Steering Committee, the Group and their advisors for their close collaboration and valuable contribution in the Meetings, and looks forward to further constructive interaction to finalise the ISB restructuring.

The agreement brings the nation closer to completing its debt overhaul two years after it defaulted.

Bondholders and the Sri Lanka agreed to a framework for a deal that includes notes linked to economic performance and a governance-linked structure as part of plain vanilla instruments, according to a statement released Wednesday at the conclusion of the second round of restricted talks.

Sri Lanka defaulted for the first time on its foreign debt in May 2022 after its economy was driven to the brink by a slump in foreign exchange reserves.

Restructuring international bonds was one of the key conditions set by the International Monetary Fund (IMF) under a $2.9 billion bailout programme that helped Sri Lanka tame inflation, stabilise its currency, and improve public finances.

The deal with selected bondholders, who cover about 50% of Sri Lanka's bonds, is contingent on confirmation by the Official Creditor Committee (OCC) made up of bilateral creditors and the IMF to ensure it is in line with the global lender's debt sustainability analysis for the country.

The framework proposes a 28% haircut on face value and 11% reduction on past interest with payments on the interest component to start from September.

The outline proposes to swap four existing dollar-denominated bonds for a bundle of three fixed income instruments.

One is a standard or so-called "plain vanilla" bond that has a coupon of 4% and matures in 2028. The second is a series of macro-linked bonds, where payouts and principal will be adjusted according to the country's economic performance - downwards in case the economy fails to hit the IMF baseline projections, and upwards if the economy outperforms.

It's lost 34% over the past year while the wider S&P 500 rose 25%.

A third instrument would be a so-called governance linked bond. While the statement did not detail the parameters to which the payout was linked, a source familiar with the situation said the country would have to pay investors less if it managed to achieve reforms demanded by the IMF and hit tax revenue targets.

Sri Lankan sovereign dollar bonds were marginally up in price on Wednesday, still trading around 57 or 58 cents on the dollar. The bonds were up nearly 15% year to date at the index level up to Tuesday's close, according to JPMorgan data.

Sri Lanka signed in late June an agreement with creditor nations including Japan, India and China to restructure about $10 billion in bilateral debt.

Sri Lanka now needs to present the proposal to all its bondholders who need to agree to the deal for the restructuring to be finalised.

The statement is given below;

ANNOUNCEMENT BY THE GOVERNMENT OF THE DEMOCRATIC SOCIALIST REPUBLIC OF SRI LANKA IN RELATION TO THE FOLLOWING SERIES OF BONDS ISSUED BY THE ISSUER:

U.S.$1,000,000,000 6.85% BONDS DUE 2024

Rule 144A ISINs: US85227SAY28; Reg S ISIN: USY8137FAN88

U.S.$500,000,000 6.35% BONDS DUE 2024

Rule 144A ISINs: US85227SBA33; Reg S ISIN: USY8137FAQ10

U.S $1,400,000,000 7.85% BONDS DUE 2029

Rule 144A ISINs: US85227SAZ92; Reg S ISIN: USY8137FAP37

U.S $1,500,000,000 7.55% BONDS DUE 2030

Rule 144A ISINs: US85227SBB16; Reg S ISIN: USY8137FAR92

(the "Bonds")

SRI LANKA ANNOUNCES SUCCESSFUL CONCLUSION OF SECOND ROUND OF RESTRICTED DISCUSSIONS WITH MEMBERS OF THE AD HOC GROUP OF BONDHOLDERS

Colombo, Sri Lanka, 3 July 2024 - The Government of the Democratic Socialist Republic of Sri Lanka ("Sri Lanka") announces today that it has held restricted discussions between 21 June 2024 and 2 July 2024 (the "Restricted Period") with nine members of the steering committee who agreed to take part in the restricted discussions (the "Steering Committee") of the Ad Hoc Group of Bondholders (the "Group", and together with Sri Lanka, the "Parties") of its International Sovereign Bonds ("ISBs"). Sri Lanka was joined by its legal and financial advisors, Clifford Chance LLP and Lazard, respectively, and the restricted members of the Steering Committee were joined by the Group's legal and financial advisors, White & Case and Rothschild & Co, respectively. The Steering Committee as a whole comprises ten of the largest members of the Group, with the Group controlling approximately 50% of the aggregate outstanding amount of ISBs.

During the Restricted Period, Sri Lanka, the Steering Committee and its advisors met during a two-day working session in Paris on 27 and 28 June 2024 (the "Meetings"). At the conclusion of the Meetings, Sri Lanka is pleased to report that, following negotiations, the Parties agreed core financial terms of a restructuring of the ISBs, the terms of which are embodied in a joint working debt treatment framework (the "Joint Working Framework"), a copy of which is included in the Annex to this announcement (which is also available as a PDF version through the link at the bottom of this announcement). In addition, the Parties agreed to include Governance-linked Bond features in the terms of one or more series of the plain vanilla bond instruments that form part of the Joint Working Framework.

As the Joint Working Framework includes a state-contingent feature, it remains to be confirmed by (i) the Secretariat of Sri Lanka's Official Creditor Committee (the "OCC") to ensure comparability of treatment with the terms agreed between Sri Lanka and the OCC ("Comparability of Treatment") and (ii) the IMF staff to ensure consistency with the parameters and debt sustainability objectives of Sri Lanka's IMF-supported Program. As such, following the Meetings, the advisors to Sri Lanka and the Steering Committee will consult with each of the Secretariat of the OCC, to confirm the consistency of the Joint Working Framework with the principle of Comparability of Treatment, and staff at the IMF, to confirm the consistency of the Joint Working Framework with the parameters and debt sustainability objectives of Sri Lanka's IMF-supported Program.

During the restricted discussions, Sri Lanka and the Steering Committee also progressed discussions on certain non-financial provisions.

Sri Lanka would like to thank the Steering Committee, the Group and their advisors for their close collaboration and valuable contribution in the Meetings, and looks forward to further constructive interaction to finalise the ISB restructuring.

Follow US

Most Viewed Stories