The Monetary Policy Board decided to keep the Overnight Policy Rate (OPR) at 7.75% during its meeting yesterday. This decision aims to guide inflation toward a 5% target while balancing domestic recovery efforts and global uncertainties.

Inflation, as measured by the Colombo Consumer Price Index (CCPI), held steady at 2.1% in December 2025. While food prices rose due to festive demand and supply chain issues caused by Cyclone Ditwah, projections suggest a gradual move toward the 5% target by the latter half of 2026. Core inflation also showed a slight uptick, a trend expected to continue as economic demand strengthens.

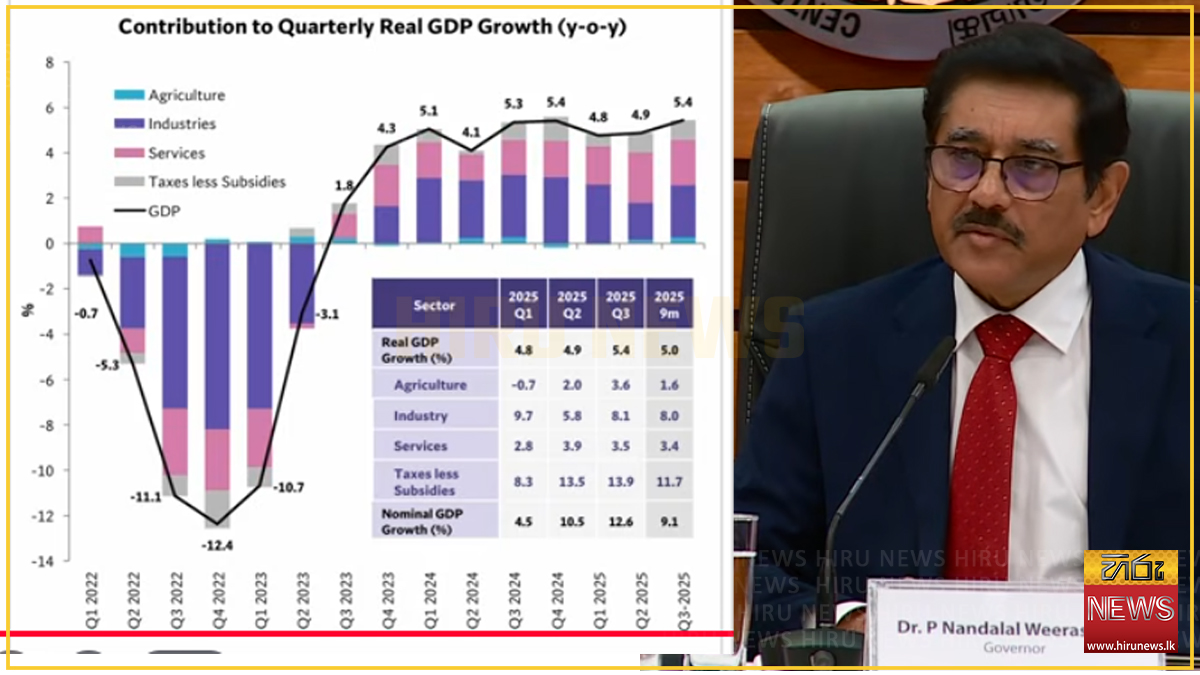

Sri Lanka's economy expanded by 5.0% during the first nine months of 2025 and demonstrates resilience despite the recent cyclone. Private sector credit grew significantly toward the end of last year, fueled by rising vehicle imports and increased economic activity. Rebuilding efforts following the cyclone are expected to further drive this credit demand.

On the external front, the current account likely recorded a surplus in 2025, supported by strong foreign remittances and multilateral inflows. Gross Official Reserves reached $6.8 billion by the end of 2025, even with substantial debt payments. While the Sri Lankan rupee depreciated by 5.6% against the US dollar over the past year, it has remained stable in early 2026.

The release of the next regular statement on the monetary policy review will be on 25 March 2026.

Inflation, as measured by the Colombo Consumer Price Index (CCPI), held steady at 2.1% in December 2025. While food prices rose due to festive demand and supply chain issues caused by Cyclone Ditwah, projections suggest a gradual move toward the 5% target by the latter half of 2026. Core inflation also showed a slight uptick, a trend expected to continue as economic demand strengthens.

Sri Lanka's economy expanded by 5.0% during the first nine months of 2025 and demonstrates resilience despite the recent cyclone. Private sector credit grew significantly toward the end of last year, fueled by rising vehicle imports and increased economic activity. Rebuilding efforts following the cyclone are expected to further drive this credit demand.

On the external front, the current account likely recorded a surplus in 2025, supported by strong foreign remittances and multilateral inflows. Gross Official Reserves reached $6.8 billion by the end of 2025, even with substantial debt payments. While the Sri Lankan rupee depreciated by 5.6% against the US dollar over the past year, it has remained stable in early 2026.

The release of the next regular statement on the monetary policy review will be on 25 March 2026.

Latest News

Ex-President Wickremesinghe at Fort Magistrate’s Court

Local

28 January 2026

Singer Fashion Academy showcases next-generation talent at En Vogue 2026

Local

28 January 2026

BOI pushes investment in Sri Lanka’s emerging university towns

Local

28 January 2026

Central Bank warns against high-yield plantation investment schemes

Local

28 January 2026

USD 2 billion vehicle imports in 2025

Local

28 January 2026

First Sri Lankan US Navy SEAL graduate passes away

Local

28 January 2026

IMF staff concludes visit to Sri Lanka

Local

28 January 2026

Altair issues over 100 title deeds following ownership change

Local

28 January 2026

Sri Lankan economy grew by 5.0% during first 9 months in 2025

Local

28 January 2026

Cleantech becomes Lanka’s first GP Certified recycler

Local

28 January 2026