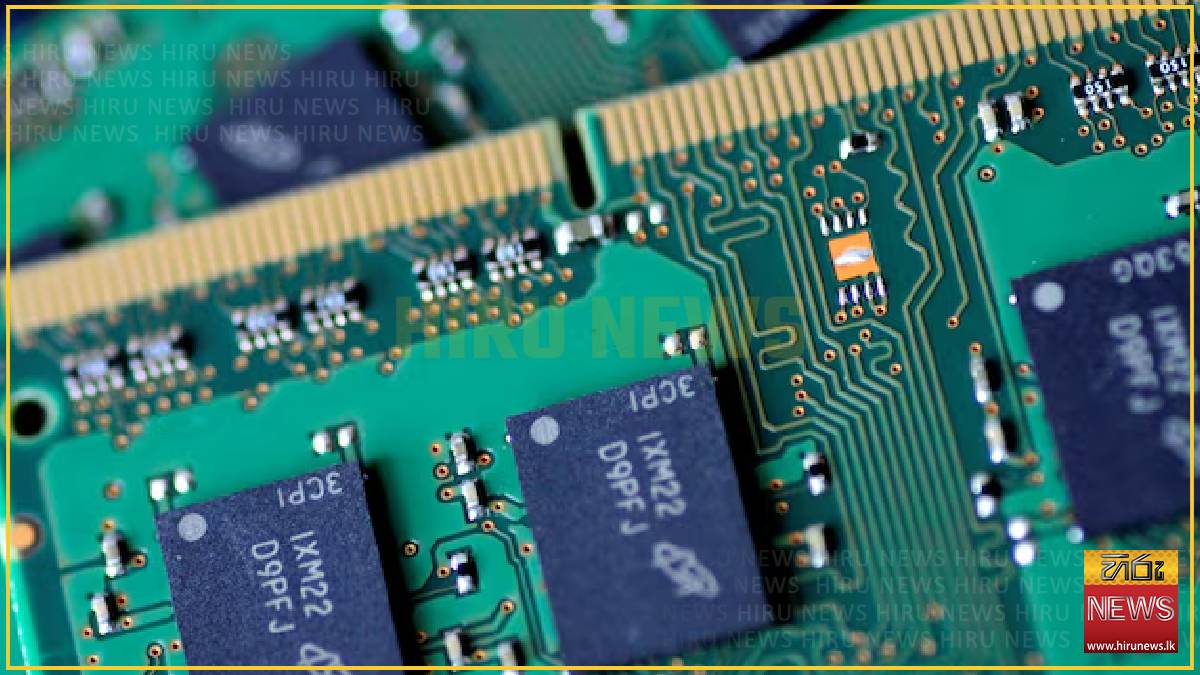

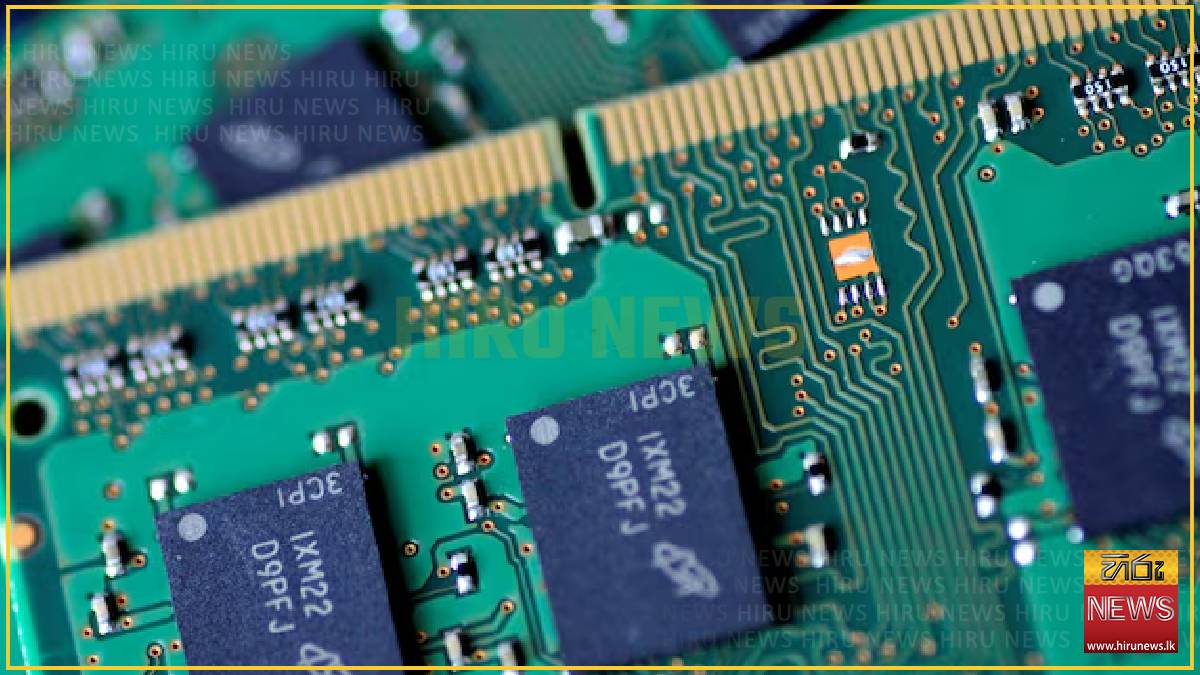

Global demand for smartphones, personal computers and gaming consoles is expected to shrink this year as companies from Britain's Raspberry Pi to HP Inc raise sticker prices to offset surging memory chip costs.

The rapid build-out of artificial intelligence infrastructure by U.S. tech firms such as OpenAI, Alphabet-owned Google and Microsoft has absorbed much of the world's memory chip supply, pushing up prices as manufacturers prioritize components for higher-margin data centers over consumer devices.

Samsung, SK Hynix and Micron, the world's three largest producers of memory chips, have said in recent months that they were struggling to keep up with demand as they reported rosy quarterly earnings on the back of surging prices for their semiconductors.

But the price surge is rippling through consumer markets.

Research firms IDC and Counterpoint both now expect global smartphone sales to shrink at least 2% this year, in a sharp reversal from their growth outlook a few months ago. That would mark the first annual decline in shipments since 2023.

The PC market is expected to shrink at least 4.9% in 2026, IDC estimated, after an 8.1% growth last year. Meanwhile, console sales are expected to fall 4.4% in the current year after an estimated growth of 5.8% in 2025, according to TrendForce.

TOUGH CHOICES FOR MANUFACTURERS

While several firms have already raised prices, industry heavyweights Apple and Dell face a tough choice: take on the costs and sacrifice margins or pass them onto consumers at the risk of stifling demand.

"Manufacturers might absorb some costs but given the scale of the shortage, it is certainly going to show up as higher prices for consumers," Emarketer analyst Jacob Bourne said.

"It is going to result in more tepid consumer device sales in 2026. It will be a challenge for these companies that are trying to sell products during a time of broader inflation."

Pressure is being compounded by expectations that the price increases will persist, possibly into next year. Counterpoint estimates that memory prices will jump 40% to 50% in the first quarter, after last year's 50% surge.

HP CEO Enrique Lores said in November the company would raise PC prices due to "significant" memory chip costs, while Raspberry Pi CEO called the cost surge "painful" in a December blog post, opens new tab announcing price increases for its devices.

The weaker demand outlook could also hamper sales at electronics-focused retailers such as Best Buy, which had already warned last year that tariff-driven price increases could dissuade potential buyers.

Apple will report earnings on January 29, while Dell is slated to report on February 26. Xiaomi usually reports in late March.

APPLE'S MARKET POWER

Some analysts said Apple, with its scale, pricing power and deep supplier network, is better positioned to weather the memory chip price surge than its smaller rivals.

The company typically holds prices of its flagship iPhone lineup in the U.S. steady between its September launch events. Last year, it absorbed the hundreds of millions of dollars in tariff-related costs, instead of passing them on to customers.

"Apple is better-positioned, as it uses contract pricing (rather than more volatile spot pricing) for its purchases, securing better prices," Morningstar analyst William Kerwin said.

"But it isn't immune, and may need to raise prices to pass on higher input costs."

Source: Reuters

The rapid build-out of artificial intelligence infrastructure by U.S. tech firms such as OpenAI, Alphabet-owned Google and Microsoft has absorbed much of the world's memory chip supply, pushing up prices as manufacturers prioritize components for higher-margin data centers over consumer devices.

Samsung, SK Hynix and Micron, the world's three largest producers of memory chips, have said in recent months that they were struggling to keep up with demand as they reported rosy quarterly earnings on the back of surging prices for their semiconductors.

But the price surge is rippling through consumer markets.

Research firms IDC and Counterpoint both now expect global smartphone sales to shrink at least 2% this year, in a sharp reversal from their growth outlook a few months ago. That would mark the first annual decline in shipments since 2023.

The PC market is expected to shrink at least 4.9% in 2026, IDC estimated, after an 8.1% growth last year. Meanwhile, console sales are expected to fall 4.4% in the current year after an estimated growth of 5.8% in 2025, according to TrendForce.

TOUGH CHOICES FOR MANUFACTURERS

While several firms have already raised prices, industry heavyweights Apple and Dell face a tough choice: take on the costs and sacrifice margins or pass them onto consumers at the risk of stifling demand.

"Manufacturers might absorb some costs but given the scale of the shortage, it is certainly going to show up as higher prices for consumers," Emarketer analyst Jacob Bourne said.

"It is going to result in more tepid consumer device sales in 2026. It will be a challenge for these companies that are trying to sell products during a time of broader inflation."

Pressure is being compounded by expectations that the price increases will persist, possibly into next year. Counterpoint estimates that memory prices will jump 40% to 50% in the first quarter, after last year's 50% surge.

HP CEO Enrique Lores said in November the company would raise PC prices due to "significant" memory chip costs, while Raspberry Pi CEO called the cost surge "painful" in a December blog post, opens new tab announcing price increases for its devices.

The weaker demand outlook could also hamper sales at electronics-focused retailers such as Best Buy, which had already warned last year that tariff-driven price increases could dissuade potential buyers.

Apple will report earnings on January 29, while Dell is slated to report on February 26. Xiaomi usually reports in late March.

APPLE'S MARKET POWER

Some analysts said Apple, with its scale, pricing power and deep supplier network, is better positioned to weather the memory chip price surge than its smaller rivals.

The company typically holds prices of its flagship iPhone lineup in the U.S. steady between its September launch events. Last year, it absorbed the hundreds of millions of dollars in tariff-related costs, instead of passing them on to customers.

"Apple is better-positioned, as it uses contract pricing (rather than more volatile spot pricing) for its purchases, securing better prices," Morningstar analyst William Kerwin said.

"But it isn't immune, and may need to raise prices to pass on higher input costs."

Source: Reuters

Latest News

Three construction workers killed in embankment collapse

Local

22 January 2026

147th Battle of the Blues set for March at SSC

Local

22 January 2026

Vajira Netthikumara elected as President of Netball Sri Lanka

Local

22 January 2026

Maskeliya Police raid illicit distillery

Local

22 January 2026

Court of Appeal to deliver order on Trincomalee Buddha Statue case

Local

22 January 2026

Kim Petras asks to leave record label

Local

22 January 2026

Tenacious D to return after Trump controversy

Local

22 January 2026

Chip price surge hits tech makers

Local

22 January 2026

Slot praises Salah return

Local

22 January 2026

Bajaj Chetak returns, electrified for a new generation

Local

22 January 2026